Showing posts with label Buying. Show all posts

Showing posts with label Buying. Show all posts

LOOKING FOR A GOOD TIME?

Why it’s a good time to buy a home

By Mark Weisleder

Toronto Star Jan 27 2012

I believe there has never been a better time to buy a home. I’ve been in the industry for 28 years as a lawyer and I haven’t seen so many positive signs for housing, whether you are thinking or buying or locking in a mortgage.

Here’s why:

Mortgage rates at historic lows: They can’t get any lower. Four to five-year fixed mortgages at 3 per cent are unheard of. It is lower than the variable rate that most Canadians have been paying for years. Rates have nowhere to go but up, either later this year or next. If you are paying a variable interest rate, lock in now.

Canada’s appeal: This country has everything going for it — a stable banking and political environment, steady real estate market, the natural resources people want and few social tensions. That makes us a safe haven in a volatile world.

Our immigrant draw: Because of the above, we’re a draw for immigrants, often wealthy ones. When they get here, they need a home. So in my view while the real estate market may level off in some areas of Ontario, it should stay strong in most of the GTA and likely Canada’s other large urban centres as well.

Mortgage defaults: According to CMHC, over 99 per cent of Canadians pay their mortgages on time. It quite a different picture in the U.S. where 7 million homes are in foreclosure and perhaps another 7 million homeowners are under water. This represents almost 15 per cent of all homes. So while the American housing market will likely be weak for the next few years, this should not occur in Canada. Our banks are not dumping homes onto the market, so there is no downward pressure on prices.

Recourse Mortgages: In many U.S. states, if you can’t pay your mortgage, the only thing the bank can do is foreclose; they cannot sue you for any shortfall. So when homes go under water, owners give the keys back to the bank. In Canada, loans are almost all Recourse, meaning if you don’t pay and there is a shortfall, the lender can sue you for the difference. This is another reason why, in my opinion, even if times do get tough, Canadian homeowners will find a way to make the payments until things improve.

Income-to-price ratio: Another misleading statistic is that in major markets, like Toronto, the average price of a home is now 4.6 times the income of the average Canadian. This same statistic was found just before the U.S. and UK markets went into the tank. However, if you look at median incomes of Canadians against the median cost of homes, this average comes down to around 3.5, which is not dangerous. Using averages are wrong. A person receiving social assistance will not buy a home, and should not be included in any relevant statistic.

High consumer debt: The warnings about rising debt ratios must be examined carefully. The Governor of the Bank of Canada is worried that the average personal debt ratio is now 156 per cent in Canada. This means a household making $100,000 per year, owes $156,000, two-thirds of which is mortgage debt. Why is this so bad? At an interest rate of 3 or even 5 per cent, the amount needed to service the debt is manageable. Most people do not pay off their mortgages in one year. Still, this is another good reason to consolidate your debt now, at these low interest rates, and lock in.

No guarantees: Nobody can predict the future and there’s always the possibility of a major economic shock. Yet, in a U.S. presidential election year, politicians will do whatever is necessary to prevent it. If the economy goes into the tank, so do re-election chances. The U.S. is already showing signs of economic recovery.

No matter what, do not take on a monthly payment higher than what you can afford. Meet with your lender or mortgage broker in advance to figure out what you can afford before you start looking for a home. It may be the best time to buy, but you need to buy smart.

Photo By: alykat

RESALE NEWS

Calgary sees more home resales as average price drops

By Mario Toneguzzi

Calgary Herald November 30, 2011

Calgary's resale housing sales grew in October, but the average price dipped, according to the Conference Board of Canada.

In a report published Tuesday, the board said the seasonally adjusted annualized rate of sales in Calgary was 22,572 during the month, up from 22,344 in September and an increase from 19,524 in October 2010.

But the average price fell in October to $402,561 from $408,466 in September. A year ago it was $396,041.

As for new listings, the annualized rate in October decreased to 43,656 from 44,664 the previous month, but up from 42,960 in October 2010.

In October, the sales-to-new listings ratio in Calgary was 0.512. It was 0.471 in September and 0.455 a year ago. The conference board said Calgary can expect short-term year-over-year annual price growth of between five and seven per cent.

According to the latest Canada Mortgage and Housing Corp. market outlook report, MLS sales in the Calgary region are forecast to increase by 2.3 per cent in 2012 to 22,700, while new listings are expected to decrease by 1.1. per cent to 43,700. The average MLS sales price is forecast to jump by 2.2 per cent in 2012 to $411,000 in the Calgary census metropolitan area.

The CMHC housing market outlook says despite many positive factors for real estate, "competing factors such as uncertainty in the global economy has kept some prospective buyers on the fence and will continue to temper any large increases in sales."

Photo By: Where To Willie

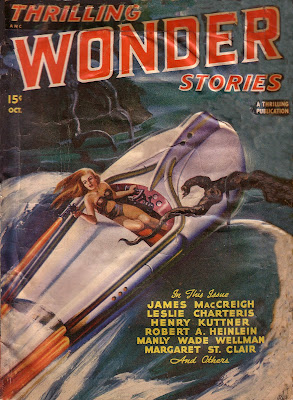

YOU KNOW IT'S THRILLER

The 'thrill' of buying a house

William Hanley, Financial Post

Apr. 21, 2011

You walk into the open house, take one look and say to yourself: This is it. It’s the house I have to live in. Where do I pay? A bidding war? I’m in.

Over my years of buying houses, I never bought one that did not have that frisson moment, that thrill of finding a place so suited to my wants. Indeed, I have in the past decided that I wanted to buy a house in what seems, in retrospect, to be nanoseconds. (By contrast, I’ve taken weeks to decide on the right pair of shoes.)

It is no way to make an “investment,” to be sure. But, as I’ve previously discussed in this space, buying a house is perhaps the most uninvestment-like of investments.

Just about anyone who’s purchased a property or thought about purchasing knows that it is much about gut-feel, in which the senses can conspire to trump sense.

Now, as the major real estate selling season gets under way, along comes a survey commissioned by BMO Bank of Montreal to give statistical weight to the notion that intuition carries a particularly heavy weight in the house-buying process.

The survey by Leger Marketing found that more than two-thirds of Canadians cited a “good feeling” toward the property as a reason to buy. Meantime, though, good sense is not thrown out of that gorgeous bay window and into those manicured flower beds. More than 90% of house-hunters value affordability and location over resale value.

So, the axiom that there are three important things in real estate – location, location and location – might reasonably be replaced by the Three Ps: Price, place and personality.

Nevertheless, that resale value is not a big concern to these surveyed house-hunters – people between 25 and 45 who plan to buy a home within two years – is a telling sign of the real estate times.

With some dips here and there, Canadian house prices have been rising strongly for more than a decade. Indeed, even the recession created just a downward blip in the chart of ever-growing values, with the average national price rising 8.9% last month from the previous March (but just 4.3% excluding Vancouver).

As a result, most of the house-hunters surveyed might never have been aware of a housing market that was not rising. I suspect many in this 25-to-45 demographic believe house prices basically keep going up forever, that though they downplay resale value in the survey, the expectation for solid gains is, well, a given. (Any significant drop in prices would surely shake that belief.)

In recent times, investors have been asked if they are stocks or bonds. If you’re a stock, you are prepared to take on more investment risk. If you’re a bond, you are not.

Perhaps, though, many people are probably houses when it comes to investing. A home is both partly a stock and a bond – and somehow neither.

It is a bond because over the long term it will likely produce modest returns through the enforced savings required by paying down the mortgage. It is a stock because the gains could be outsized if the investor were to buy and sell at propitious entry and exit points for market-timing gains.

And it is neither because it is an “investment” with many moving parts and frictional costs. You don’t live in a stock or a bond, but when the house leaks, it costs money and cuts into the investment. Meantime, the costs associated with buying and selling a property are becoming more daunting in many jurisdictions, with some observers reckoning that a house is often a mediocre investment at best.

But most young first-time buyers and mover-uppers are not fazed by such commentary. Home ownership is a cornerstone of our culture, with 70% of the population owning properties and many of the other 30% looking to join the majority.

And the real estate industry has become far more adept at marketing and selling than in the days decades ago when I was in the market. Today, houses are often professionally “staged” to produce that frisson moment. Prices are sometimes set artificially low to produce that exciting bidding war and that extra frisson of “winning.”

A house, it is said, is not a home. And a home is not strictly an investment. But does a stock have granite counters? Does a bond have stainless steel appliances?

ADVICE TO SURF THE WAVES OF MORTGAGES

Brokering the best mortgage deal

Experts able to navigate through choppy waters

By Denise Deveau

For Postmedia News March 30, 2011

Cheryl Hutton and Aaron Coates always thought getting a mortgage would be a challenge.

But within 18 days of visiting a mortgage broker, they were able to close a deal on a new townhouse in Calgary without a hitch.

Now in their early 30s, both have careers in the theatre, something Hutton says has been a bit of a sticking point with banks.

"In our industry, we never fit the paperwork guidelines (for the banks). For some reason people don't think we pay our bills."

Although it was their first home purchase, Hutton says it was surprising how easy the whole process was once they had someone who could walk them through it.

"He sat us down, told us what our options were, showed us that it was possible, and explained all the steps we needed to take. If it wasn't for him, we may not have made the leap," she says.

Sorting through a mortgage process and negotiating rates can be overwhelming for first-time and seasoned homebuyers alike.

That's why people such as Hutton and Coates turn to brokers to do the legwork for them.

Yet mortgage brokers will tell you that a good number of homebuyers out there don't really understand what they do.

"Part of the challenge we have in our world is that people aren't really sure what a mortgage broker is," says Gary Siegle, regional manager for Invis Inc., a mortgage brokerage firm in Calgary.

Brokers should not be confused with "rovers" -mortgage specialists attached to a specific financial institution who visit customers outside of banking hours, he explains.

"They only deal with that bank's product. A broker, however, is an intermediary whose job is to make a match between a lender and a borrower. We represent the individual, not the bank."

About 30 per cent of mortgages in Canada are done through a broker, says Perry Quinton, vice-president of marketing for Investor Education Fund, a Toronto-based, non-profit financial information service.

"The reason more people don't know about them is because the banks are so visible," he says.

"It's easy to gravitate to them when you have your savings accounts, credit cards and investments there already."

Going for the comfort factor could cost you though, she adds.

"A broker has access to different lenders including banks, and can shop rates and features. A half per cent may not sound like much, but that could make a difference of about $20,000 for a $250,000 mortgage amortized over 25 years. Any little bit helps."

For anyone considering a broker, Quinton advises people to do a bit of groundwork first if they have the time.

"It helps to educate yourself about options and what you can afford. Look at all your living expenses, including student loans and credit card debt. Chances are you are understating those."

Another thing to look into is the different types of available mortgages and features, including interest rates, payment frequency, amortization, cash back programs, and the ability to make lump sum payments.

"Knowing these things before you go in can save you a lot of money," she adds.

Photo By: alfcfishing

Subscribe to:

Posts (Atom)